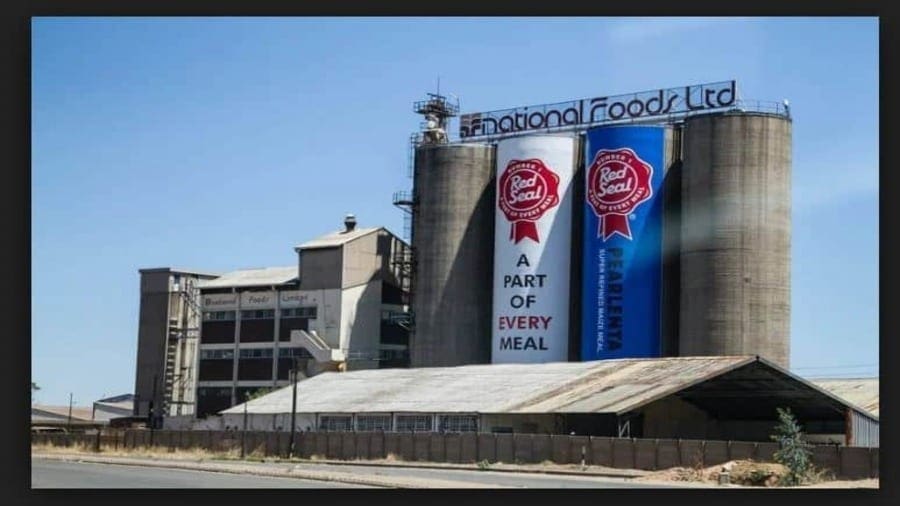

ZIMBABWE – Zimbabwe’s leading food processor, National Foods Holdings, is projected to achieve a 17% growth in revenue to hit US$ 300 million year on year on the backside of improved production capacity and product mix.

The Herald reports that Nat Foods, which is listed on the Victoria Falls Stock Exchange (VFEX) has continued with its ongoing capacity expansion initiatives providing volumes upside.

The food processing giant migrated to the VFEX this year and its share price on the US dollar-denominated exchange is seen improving to US$2,31, with IH Securities giving it a BUY recommendation.

The food giant revealed that its strategic focus for management will be on optimizing trading performance and implementation of projects to transform NatFoods from a producer of basic food commodities into a more diversified FMCG player with a larger basket of products.

According to the group, near-term projects include the commissioning of a new flour mill in Bulawayo that will increase wheat milling capacity by an additional 2,000 tonnes, a breakfast cereal plant, and a new biscuit line

The board has also approved a US$5,3 million upgrade of the Harare rice plant, a further investment of US$1,5 million in the hard snacks category, and an investment into a domestic pasta plant.

While the group recorded lowered margins at the half year, they are still above historical averages, and analysts — IH Securities anticipate further correction and normalization going into financial 2023.

“We estimate that National Foods’ topline will grow 17 percent year on year to US$302,48 million in the financial year 2023.

Recently, the group expanded its product portfolio by launching a new production line solely aimed to process traditional grains in a bid to create jobs, boost business for local farmers, and feed into the national health and nutrition goals.

In addition, the company invested US$7 million investment in a new facility to bolster its presence in the breakfast cereal category.

According to the group’s view, Revenue in the financial year 2024 will slow down as pricing pressure from wheat inputs subsidies, hence, the stockbrokers forecast an EBITDA of US$25,71 million to FY23 representing a margin of 8,5 percent.

However, the stockbrokers observe that volumes sold in maize and stock feeds are likely to be weak in the last quarter of the financial year 2023 due to projected over-supply of the harvest on the domestic market

Similarly, the raw material pipeline for National foods from the domestic market is looking promising as the company has invested US$12 million into the summer crop contract scheme lessening its import bill.

Overall, the group is hopeful that it would see volume recovery stemming from the anticipated benefits of Government measures to tame inflation and bring economic stability, in addition to improved agriculture production.

For all the latest grains industry news from Africa, the Middle East and the World, subscribe to our weekly NEWSLETTERS, follow us on LinkedIn and subscribe to our YouTube channel